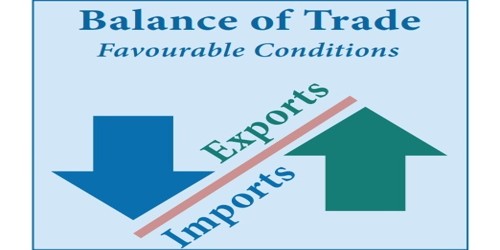

Staying informed about current events is crucial for making informed investment decisions.

Keeping track of the latest financial news can be overwhelming, but it's essential for making informed financial decisions.

Welcome to our comprehensive guide to day trading in the stock market.

If you're interested in investing in the world of digital assets, you may want to consider crypto currency.

Investing in the stock market can be an excellent way to grow your wealth and build a secure financial future.

Welcome to the digital age, where technology and data are at the heart of our daily lives.

Financial news plays a crucial role in keeping investors informed about the latest developments and market trends.

The stock market can be a great way to grow your wealth, but it can also be unpredictable and risky.

Welcome to the exciting world of crypto currency! As more and more investors jump on board, it's important to be aware of the regulations governing this digital currency.

Buying or selling a property can be a daunting process, especially when it comes to negotiation.